| | Working with Direct Deposit distribution amounts |

| Resolution | Direct Deposit Distribution Rules - Percent of Net Pay

- Always calculated on the original net amount of the check.

- Doesn't consider remaining balance after other deductions or distributions.

- Fixed Amount

- Account Management

- You can't delete accounts with history.

- To stop distribution to an account, set its amount to 0 (sets it as inactive).

- Distribution Behavior

- If you don't fully distribute a paycheck, the remaining amount goes to highest priority account.

- If fully distributed before reaching the lowest priority accounts, those accounts receive no funds.

- Adjusting Priorities

- Use the Move Up and Move Dn buttons to change account order.

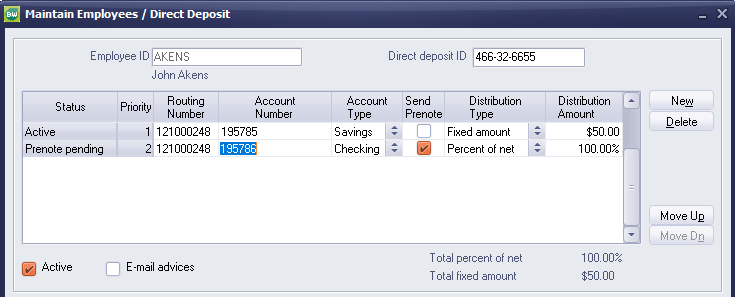

Entering Employee Banking Information - Go to Maintain Employees, Direct Deposit.

- Enter accounts in priority order (distribution follows this order).

- Required fields:

- Routing Number – Bank routing/transit number.

- Account Number – Savings or checking account number.

- Account Type – Checking or Savings.

- Send Prenote – Select to send a prenote.

- Distribution Type – Choose Percent of Net or Fixed Amount.

- Percent of Net is based on original net pay.

- Distribution Amount – Enter a fixed amount or percentage.

- Percentages across all accounts must total 100%.

How BusinessWorks Calculates Distributions - The system calculates based on:

- Account priority order.

- Distribution Type and Amount.

Example 1 - Net check: $1,000

- Distribution #1: Fixed $50 (Savings)

- Distribution #2: Percent of Net 100% (Checking)

Calculation: - Distribution #1: $50 from $1,000. Remaining $950.

- Distribution #2: $1,000 × 100% = $1,000. Only $950 available, so $950 distributed.

Example 2 - Net check: $1,000

- Distribution #1: Fixed $100 (Savings)

- Distribution #2: Percent of Net 25% (Checking A)

- Distribution #3: Percent of Net 75% (Checking B)

Calculation: - Distribution #1: $100. Remaining $900.

- Distribution #2: $1,000 × 25% = $250. Remaining $650.

- Distribution #3: $1,000 × 75% = $750. Only $650 available, so $650 distributed.

[BCB:163:Chat BusinessWorks US:ECB]

|

|